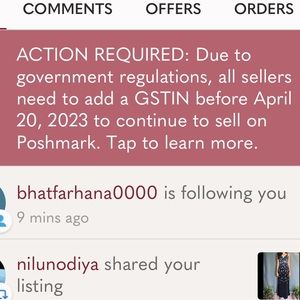

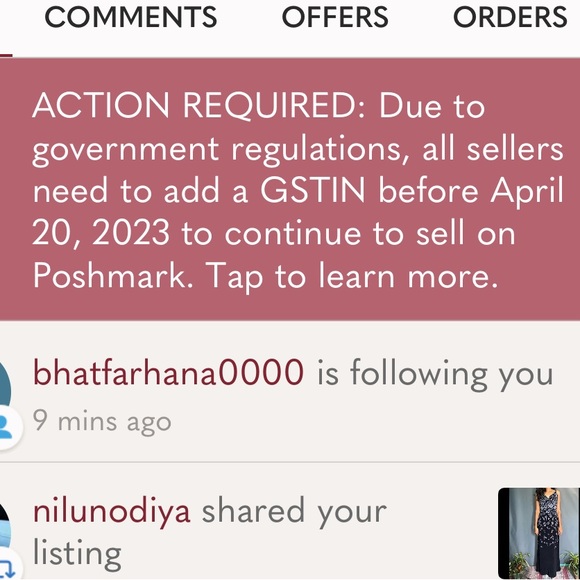

🛑ALERT🛑

NWT

₹250

Size

Not for sale

Like and save for later

Hey friends,,

Dear posh ,

Please understand once

We r not doing lakhs of business in poshmark

Why u want GST for used products???

I don’t know how to respond???

But one thing

Posh will loose many customers n turn over as well😢😭

Please tag our sellers as many as possible to intimate 🙏😢 n for clarification

🛑Please tag @pm_editor_in on every ur comment 🙏🛑

Additional Info

Shipping/Discount

sparkle_3184

and

7 others

like this

224 Comments

janujanu999

@closetbybr @closet_reloved @classic_vogue @alao137 @am384 @abhap12 @allaboutoneself @amita_ghai @amreenbeauty @amy_shop001 @and_clothing @anniekaur9 @appu_s8 @aurora_wardrobe @azaleablush @allthingszara_ @anueie @active_ranger @allionceloved

Apr 06Reply

janujanu999

@anewstar dear, what is this ??can u explain us briefly??

Apr 06Reply

amreenbeauty

Seriously this is rediculous, i was thinking the same ?! we don't make enough money on here everything is heavily discounted for buyers, then we gotta pay commission to poshmark which is fine they take GST on poshmark fee now if the government takes GST's too. I don't think it'll be worth it to sell anymore on here sadly :(

Apr 06Reply

janujanu999

@bec_care @being_butterfly @calichicthreads @closettales409 @curvy_fashionn @ctanvi @dranukapoor @deeptikunwar @darshana_2605 @diethovonuo @fierysaggi @fab__closet @flawless_hemz @glittergold9

Apr 06Reply

janujanu999

@pm_editor_in please respond as soon as possible… we all need clarity 🙏

Apr 06Reply

janujanu999

@pm_editor_in

Apr 06Reply

janujanu999

@pm_editor_in

Apr 06Reply

aurora_wardrobe

@janujanu999 Just saw this. I’m wondering how do they decide who’s liable to register. Surely @pm_editor_in won’t deactivate listings from every single closet? I for one have zero tax liability since I don’t have an income except for a few odd sales on here. So how is this supposed to work? How are students and other groups exempt from taxes or low-income taxpayers supposed to reckon with this?

Apr 06Reply

darshana_2605

I don't have a business I'm just a mom why would I get gstn no. what is wrong with Poshmark. this needs to be clearly explained by them before just abruptly asking us to do it.

Apr 06Reply

janujanu999

@amreenbeauty lets see … 😒the response from posh

Apr 06Reply

janujanu999

@darshana_2605 @pm_editor_in

Apr 06Reply

janujanu999

@aurora_wardrobe @pm_editor_in

Apr 06Reply

darshana_2605

@aurora_wardrobe they won't deactivate listing but a listings will be automatically marked not for sale apparently as mentioned in their know about page. and once gstn is registered the listings will be available .

Apr 06Reply

janujanu999

@guddu987 @garima_raj @harshita9933 @innervoice @iraa06 @indofrenchvibe @jagjit29 @jassi953 @jainpalak1301 @kapdezkloset @kajals_closet3 @kashish_verma @kavitapn_17 @lemoschris @lavangijoshi10 @latestclothes @lazy_panda_1305

Apr 06Reply

closetbybr

@pm_editor_ind @pm_editor_ind The post says for any queries write to support team- This time I literally thought poshmark will genuinely reply to my concern about GST AND I WROTE TO THEM and my heart ❤️ broke again 💔

AS ALWAYS AUTOMATED REPLY TO MY GST QUERIES

Thank you for reaching out to Poshmark! We’ve received your email and our team is working as quickly as possible to answer your questions.If your order has not been completed but you have been charged,

Apr 06Reply

closetbybr

@pm_editor_ind AS ALWAYS AUTOMATED REPLY TO MY GST QUERIES

Thank you for reaching out to Poshmark! We’ve received your email and our team is working as quickly as possible to answer your questions.If your order has not been completed but you have been charged, please note that we automatically refund these order attempts and it should post to your bank within 2-10 business

Apr 06Reply

bec_care

I do hope poshmark clears this up soon. I too haven't been able to get through to poshmark. Past few days they have only been responding with that auto generated message. It will really be difficult to sell if additional taxes are added

Apr 06Reply

closetbybr

@pm_editor_ind This issue need to be answer ON URGENT BASIS.AWAITING YOUR ANSWER AND I PRAY THAT THIS POST WITH THE QUERIES WILL NOT BE UNANSWERED 🙏🏻🙏🏻🙏🏻

Apr 06Reply

janujanu999

@bec_care i think its not about taking taxes but how we suppose to have GST NUMBER?? We r not business persons. And we r selling used things.. how they charge GST for this?? @pm_editor_in

Apr 06Reply

janujanu999

@manisha_92 @madhuraagadgil @maehekkg10 @manikachauhan @manishap1909 @m_hegde @nishu666 @nidhipatel699 @priyajumnani @preloved_mahii @poojawalia @pranayj455 @prelovedperfect @purplecloset03 @preownedloved_

Apr 06Reply

aurora_wardrobe

@darshana_2605 Yes that is what I meant by ‘deactivate’ since a listing marked ‘not for sale’ is essentially useless in terms of generating any interest. Or sales. This seems grossly unfair if they don’t provide us with an option* to circumvent this.

Apr 06Reply

aurora_wardrobe

We aren’t big businesses looking to expand operations; most of us are people who use Poshmark not as a source of supplemental income to their regular paychecks but rather as the only source, selling whatever little they can.

Apr 06Reply

janujanu999

@rachraps @ratatouille691 @reloved_f @renubeniwal @renuka29 @rinky_kaur @rucsaxena @sanateddy @shezzde1 @spendthriftxx @singharya91 @shades_of_july @sassykidwoman @sakhi_n @shailja11 @shilpasivanesan @shrmit @smita_b @simosclothes @sta2021 @surbhi_seth @sulajen @snowflake_23

Apr 06Reply

aurora_wardrobe

@janujanu999 Yes this is what I’m confused about. It’s about applying/ registering for a GSTIN (Good and Services Tax Identification Number). How are non-taxpayers even qualified to register for this? @pm_editor_in

Apr 06Reply

janujanu999

@thethriftthief @trinket_closet @tialkr @thriftstoreeeee @thriftkkata @thewaywewore_1 @thakur1112 @the_bthrift @unneesbees @veeaar25 @vibhasharma437 @vellutoclothing @wearhouseshop

Apr 06Reply

closetbybr

@a__star @anee26 @littleloots @madhuraagadgil @makimi03 @diyagshop @hardlywornit

Apr 06Reply

closetbybr

@low_behold_007

Apr 06Reply

a__star

Even if one applies for GST it’s impossible to get one before 20.4.2023 and that too they don’t give you unless you have a legit business 🤦🏻♀️. Who takes GST no. for goods lying in your closet on which you’ve already paid taxes while buying. 🤷♀️. Isn’t it enough that we pay huge commission and taxes on commission on products we’ve already paid taxes on while buying. Unless we reach a sale of 20L this shouldn’t be applied to any of us.

Apr 06Reply

janujanu999

@aurora_wardrobe now they are charging gst 1% on sold price,’telling that some PAN rule.. dear @pm_editor_in plz explain us 1.how this GST useful/works for common people?

2. Incase if we enter with GST , will u charge gst on our sale amount or withdrawals??

3.if yes , how much the % will ??

4. Will u cancel the posh commission???

Apr 06Reply

aurora_wardrobe

@a__star Exactly

Apr 06Reply

a__star

@azualacloset @noorisa @suru227 @miraithrifts @closetbybr

Apr 06Reply

janujanu999

@udhwanikajol

Apr 06Reply

sakhi_n

if i has to get GSTIN..I would have sold on Amazon..Why would I sell Nwt listing here?

This is completely ridiculous..I thought we are paying GST to poshmark and they are paying to government on our behalf..

Getting GSTIN will allow us to claim tax benefit as tax paid..but anyways the amount is very small to do such tedious work for that..

Apr 06Reply

a__star

@aurora_wardrobe Not only do you have to apply for GST, GST needs to be filed quarterly for which you need a GST consultant. Not only that they will need you to put HSN for each product which common people may not even know. So you actually will end up paying GST on sales, you’ll need to pay consultant too. And to forget the charges to file GST. Most closets will shut. I’ve already put a disclaimer on my closet.

Apr 06Reply

closetbybr

@tenyang06

Apr 06Reply

udhwanikajol

@pm_editor_in Hey please help us to get through this!!

Apr 06Reply

amreenbeauty

@sakhi_n Same thoughts here, I thought poshmark pays GST to the government as we pay GST on Poshmark fee and they're entitled to cause they're making profits cause of us. It doesn't make sense why do we have to create a GSTIN when we aren't huge businesses. Like you said we could simply sell our most NWT items on Amazon, Flipkart and so on...

Apr 06Reply

a__star

@tenyang06 🙃🙃 some us 5 max.

Apr 06Reply

sakhi_n

@amreenbeauty Getting GSTIN isn't easy ..it needs documents which we obviously don't have

Apr 06Reply

amreenbeauty

@a__star So true it's a long process for GSTIN and it's rediculous to do that when we don't earn enough and are not huge businesses lol

Apr 06Reply

amreenbeauty

@sakhi_n Yep exactly!

Apr 06Reply

miraithrifts

@a__star oh God

Am I seriously expected to get GSTIN for decluttering items from my closet? We’re not earning too much anyways from here! I will have to shut my closet only!

Apr 06Reply

a__star

@amreenbeauty Here’s hoping we sell our entire closets by 20.4.2023 😹🙈🤦🏻♀️ especially with the low ball offers we all receive and the hoaxes and ghosters. 😹

Apr 06Reply

sakhi_n

@amreenbeauty Looks like Indian government rules will take down poshmark now..

Apr 06Reply

miraithrifts

@thedesithrifter @shwetagpta 🥲

Apr 06Reply

a__star

@miraithrifts Have already put a disclaimer on my closet. 🙈🤦🏻♀️ because if this is a Government mandate I doubt POSH will be able to help us here. For me it feels like shut before take off. 🙈😭😭😭

Apr 06Reply

amreenbeauty

@a__star hahaha i hope so too. But i wanna make sure we atleast get clarity to our concerns from poshmark before we take away our closets which we've worked hard for as a seller.

Apr 06Reply

amreenbeauty

@a__star seriously though 😭😭

Apr 06Reply

miraithrifts

@a__star yeah same! I had hopes from this platform but sadly I can’t really continue now! 😭

Apr 06Reply

aurora_wardrobe

@a__star I don’t really know how any of this works. All I know is that one needs to register their sales of secondhand good only when the taxable supply is well beyond the threshold which is around 20 lakhs from business sales. Hoping we’re given some respite here.

Apr 06Reply

a__star

@amreenbeauty Under shock honestly 🙈 I hope we do hear from them

Apr 06Reply

a__star

@aurora_wardrobe Exactly right! That was my understanding too.

Small sellers like us seem to have no chance at all. So disappointed especially after spending hours on creating our closet. @miraithrifts

🙀🙀🙀🙀

Apr 06Reply

closetbybr

@sehgal29

Apr 06Reply

miraithrifts

@a__star exactly! I was toh on my way to going into it full time. Now my only hope is i g ! And that is another mystery altogether

Apr 06Reply

a__star

@miraithrifts 🥹😔 before I could even consider taking this on as business.. 🤭🤭🤭

Apr 06Reply

sehgal29

@closetbybr @pm_editor_in im just reseller not even seller cnt apply for GST im in government job. Never thought passing on preloved goods make us seller. U know very well none of reowned sites where u can pass on ur luxury has such things. I think this should be applicable to only seller n not reseller.

Apr 06Reply

miraithrifts

@diyagshop exactly dude!!!

And even if we do it on another persons gst, we will have to find someone who does the same business because that person can only do that business which is mentioned in their company’s memorandum and articles of association (Company Law gets involved) they cannot sell or transact in any thing other than that mentioned in their MOA/ AOA

Hahaha

And people like us are barely earning by selling our closet items, we pay gst, we pay consultants, what is left for us?

Apr 06Reply

closetbybr

@diyagshop indeed a proper channel to inform the community was what was expected from poshmark team india but this didn’t happen from there side- I am still hoping that it’s some glitch which keep happening in poshmark ( Finger cross) BUT FOR SURE WE ALL AS A POSH COMMUNITY WOULD NEED AN ANSWER BY TOMORROW @pm_editor_ind

Apr 06Reply

miraithrifts

@diyagshop yes absolutely

This was actually my only source of income since I am in the process of changing careers

I had started de cluttering my closet so that I could earn a little and the clothes that are just lying around are actually used by someone who wants them!

Apr 06Reply

miraithrifts

@diyagshop yeah! There isn’t much posh will be able to do immediately

Apr 06Reply

littleloots

Hi! I'm relatively new here. Can't imagine how disheartening this must be for you guys. Just a thought. what if everyone shifts to I G? All the shopping pag es that I follow over there who do drops once or twice a week are usually sold out of at least 70-80% of their listings. If you guys shift there and take your followers with you, and if everybody from here gets together and actively promotes each other's I G business pages too, I think it may actually be a better platform to sell on.

Apr 06Reply

littleloots

What if we each create a business page over there for ourselves and put up a disclaimer post on each of our closets here redirecting potential buyers from this platform to our I G pages in case they're interested in our listings. Most of these page owners take payments in advance and run on a strict no return/no refund basis. Most of them are also selling at much higher prices than some of you are, and they still sell out. Does this seem like a viable option to you bunch?

Apr 06Reply

littleloots

Also, Delhi very seems to service most pincodes and it is pretty easy to ship with them. Lesser hassle than this place IMO

Apr 06Reply

suru227

So apparently this GST Thingy was implemented last year in poshmark Canada.

This year it seems to be implemented here .

No Indian Poshmark Sellers earn 20 lakh annually through poshmark so filling GST RETURN must be tedious for many Sellers and a burden as well.

Getting a GST number is no biggie but repercussions of having it must be. like one must file taxes monthly or quarterly basis but as we are low key players so we have to fill Nill return.

Apr 06Reply

miraithrifts

@diyagshop yes I know right!!

I’ll probably take a screenshot of the notes and keep them with me now

Also, all the best for your exams!

Hopefully there’s a solution soon

Apr 06Reply

miraithrifts

@littleloots it’s a little difficult to get buyers to come to I G because here they trust that they won’t be looted

Many people have been looted by a number of I G pages

I already have an account there but sales are very slow right now

But yes we can surely ask people to shift

Apr 06Reply

miraithrifts

@suru227 yeah true

The return filing is tedious, every quarter

The fees for filing gst

Plus paying a consultant to do it

Plus any penalties if not filed on time

It’s just a tedious job

And most of us are just earning a few thousands from here so don’t know how worthwhile it’ll be

Apr 06Reply

miraithrifts

@diyagshop yepp

Oyela it is now!

Apr 06Reply

littleloots

@miraithrifts Ah ok. Thank you for that insight!

Apr 06Reply

miraithrifts

@aurora_wardrobe so the tax on our income and gst are two separate things

It doesn’t matter if you’re in low income group or no income group

Anyone who provides interstate sales that is seller in a different state and buyer in a different state, the seller needs to be registered as per the GST Law

There is not much poshmark can do about it unless they find a loophole or something

Apr 06Reply

miraithrifts

@amreenbeauty poshmark was taking gst on the services it provided to us and not on the sale per se

From what I understand

Apr 06Reply

miraithrifts

@littleloots no worries :)

Apr 06Reply

suru227

@littleloots loots its sound good but That platform demands different kinds of presentations for sales .

@miraithrifts Exactly.. it's not that worth it because if someone will follow the same business route path ( having proper GST and all) why would anyone give 25%cut to a platform ITS HUGE.

Apr 06Reply

miraithrifts

@suru227 yeah true about the presentation also

And like just posting a product won’t get you anywhere

You needs to make reels and stay veryy consistent with the reels particularly

Apr 06Reply

littleloots

@suru227 Yeah, that's true. Don't you guys think that Oyela will also eventually have to follow suit on this new mandate though?

Apr 06Reply

miraithrifts

@suru227 yeah exactly

20% commission, 18% gst on services of pm, 1% tcs and then another I think 18% GST on sales

Its too much

Apr 06Reply

miraithrifts

@monk777 @thriftswithlove

Apr 06Reply

suru227

@miraithrifts Damit it so true 🫤Out of sight out of mind kinda Funda .. Consistency is key ..And nobody wants to scroll after 20 posts max to max .This is why PM is better because it is a selling app .

Apr 06Reply

suru227

@littleloots I have an account there as well ,umm It didn't work for me I would say .But yeah regarding that GST implementation thing .. Definitely maybe in June or in 6 months .

Apr 06Reply

allthingszara_

@pm_editor_in this is ridiculous. No one is going to use poshmark if this happens,

Apr 07Reply

lazy_panda_1305

i already pay tax to govt. as per new tax rule, this is rediculous, so much harrassment by money deduction from everywhere, and govt. wont provide gstin to people doing merely reselling and below 20L bussiness earning

Apr 07Reply

luxuryrehomed

@janujanu999 thank you for the tag. @pm_editor_in @anewstar I think you should arrange to address this concern for the poshers selling here. As far as I am aware,

1. Selling of personally used goods should not attract taxes. So are the seller's here who are selling personal belongings required to have a gstin in the first place?

Apr 07Reply

luxuryrehomed

@janujanu999 @pm_editor_in @anewstar

2. If yes, registering for gstin requires proof of incorporation of business. Most of us here are ordinary girls and women who are just destashing personal goods for some extra cash and it can't really be called a business in the true sense.

Apr 07Reply

luxuryrehomed

@janujanu999 @pm_editor_in @anewstar

3. When we click on the link of Poshmark to enter gstin, it states that if a person doesn't provide gstin, he/she is accepting that he is selling goods not for furtherance of business. Require a clarification there as that is the case with most of us.

I think addressing this issue at the earliest would avoid a lot of discontent amongst the Poshmark community and business impact on PM also. please treat this as priority.

Apr 07Reply

allaboutoneself

@pm_editor_in please team, give a thought to all those mails you receive, we have always chosen this platform over others. hoping you will come up with a solution for this too.

Apr 07Reply

janujanu999

@dranukapoor but no one is responding still from PM

Apr 07Reply

latestclothes

very bad news, going to close my Profile here.😔

Apr 07Reply

janujanu999

@dranukapoor i read that thing also … what is “”furtherance of business “”related to this???

Apr 07Reply

luxuryrehomed

@janujanu999 I think they will in the due course of time. This has come out of the blue from somewhere. My guess, even PM would have received a backlash from somewhere. The gstin regulations state that individuals selling goods through ecommerce platforms should be registered for gstin :( If it's a government mandate, wait and watch is the best we can do at the moment.

Apr 07Reply

luxuryrehomed

@janujanu999 that means we are undertaking that we are not selling goods here for business purpose.

Apr 07Reply

janujanu999

@dranukapoor which means… by not providing gst we accept that we are not sellers to expand our business, but in notification it’s clearly saying if we don’t provide gst ,our listings will be not for sale after entering gst details, listings will be available… this is mainly what bothers me😭

Apr 07Reply

luxuryrehomed

@janujanu999 they need to clarify the contradiction. we can't expect a response till Monday I think. Their offices would be closed due to good Friday and Saturday, sunday.

Apr 07Reply

rachraps

@pm_editor_in

Apr 07Reply

rachraps

@kumtiaier14 @monk777 @rranee @a__star @allthingszara_ @azaleablush @aapkidukaan @alao137

Apr 07Reply

rachraps

@tialkr @sulajen @spendthriftxx @swatigoyal2705 @calichicthreads

Apr 07Reply

thriftswithlove

@miraithrifts Now, if this is seriously a truth we need to put a disclaimer on our closest too for getting them cleared asap. Never imagined this day would ever come on poshmark, But why suddenly this rule and how are we even eligible to get an GSTIN number we are not even full time sellers we are only clearing our closet by reselling them. WHAT IS THIS HAPPENING??🥺

Apr 07Reply

kumtiaier14

@anilaamit @jagjit29 @janujanu999 @moomoo93 @ambareen123 @ambreenbeauty @dranukapoor @darshana_2605 @drakshayseth @rachraps @rranee @sasamavi @sehgal29 @sakhi_n @sl6655 @suru227 @shreapeter @mala_spice @janhvi_1 @jnodiya @jomcollection @sheebachadha @closetbybr @closethrift @c

Apr 07Reply

kumtiaier14

@a__star omg thank you for highlighting this !! We are from north east and fall under ST category and have no clue.. why must we must for used products ?? This is absurd and the NWT we can easily sell it else where in many apps these days which are providing is the platform

Apr 07Reply

thriftswithlove

@a__star After this GSTIN announcement I'm sure more than 90% of sellers are going to deactivate their account, We have always prioritized Posh as No.1 than any other app.

I don't think in this posh can do anything for us because this is govt rules so unfortunately I think we have a too either clear our closet before 20 april or find any alternative options for our source 🥺

Apr 07Reply

thriftswithlove

@thriftstoreeeee @wearnew_2022

Apr 07Reply

unsjewel

Gstin is free if you apply.

Apr 07Reply

a__star

@thriftswithlove I can’t think of any alternate option 🥹

Apr 07Reply

sakhi_n

@dranukapoor Anyways those register as boutique have to provide GSTIN..so they will close all the closets and only boutiques wil be there

Apr 07Reply

a__star

@kumtiaier14 exactly !! This is absurd!

Apr 07Reply

pm_editor_in

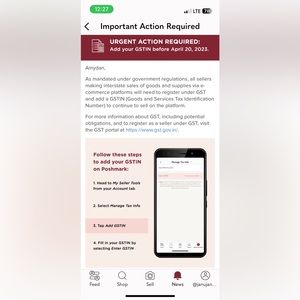

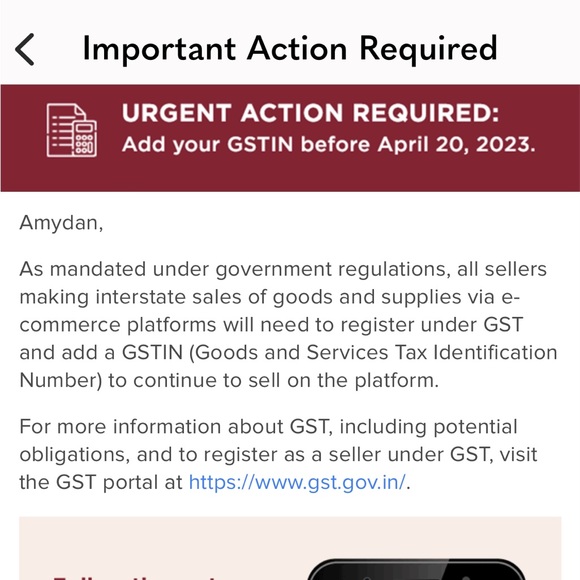

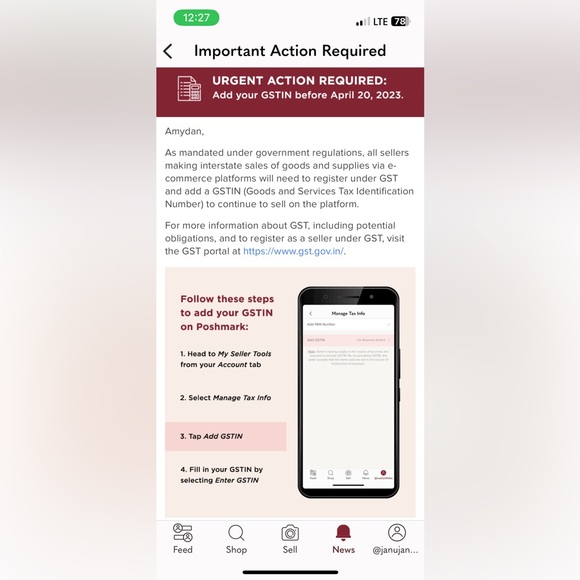

Hello Poshers!

We hear you and we’d like to reiterate that this is a Government mandate. All sellers making inter state supplies, irrespective of turnover, selling on E-Commerce platforms must have a GSTIN. Unfortunately, at this juncture, a second hand sale is not recognised separately. We understand your concerns and have been communicating to the authorities about the same and will continue to work to empower and enable our communities to thrive.

Apr 07Reply

pm_editor_in

This requirement is not just for Poshmark but for any E-commerce marketplace with strict penalties for non-compliance. As Poshmark strengthens our footprint internationally, we would like to ensure that we as a community adhere to the laws of the land and grow together, with many promising opportunties ahead.

We are committed to supporting all our members and look forward to your continued presence and engagement on Poshmark India.

Apr 07Reply

janujanu999

@pm_editor_in

what about gst % u would collect from our sales??

And what about % of posh commission??

Will u decrease the %??

We paid 1% as gst still now?? What is the use of that??

Please respond to all our queries 🙏

Apr 07Reply

darshana_2605

guess it's time to say goodbye. !

Apr 07Reply

closetbybr

@ratatouille691 @classic_vogue

Apr 07Reply

appu_s8

@janujanu999

With the lil amount we are getting here after deductions, why should we follow this!!

Apr 07Reply

appu_s8

@a__star totally agree!! 🙄

Apr 07Reply

sasamavi

It’s sad, the app itself is amazing. Apart from the offers and commission still got to re home some of my stuff and was looking forward to continue.Hope something can be done about it

Apr 07Reply

a__star

@pm_editor_in It’s only upto POSH to help make this distinction with the Government between 2nd hand and first. Most of us will be gone if we need to get GST just to sell sending hand goods.

I really hope you can help us find a solution. Really hoping 😔🥹

Apr 07Reply

mala_spice

oh noo! I was just starting to get into making a few sales. This is too bad.

Apr 07Reply

a__star

@appu_s8 Don’t think we are getting an option here. Will have to say bye bye soon 🥹😭

Apr 07Reply

thriftswithlove

@a__star I think more than 90% of sellers will quit this platform in this case.

it's a final time to say goodbyes now🥺

will really miss this platform💕

Apr 07Reply

sehgal29

@pm_editor_in who r seller who intent to make profit and here we r reselling it on loss. And by this logic we r not even legally allowed to sell these branded goods bcs all the brand or label dnt allow to resell and they are for personal consumption. This is unfair scrutiny the purpose of prelove reuse come to an end! 99 percent of us r in jobs practice we cnt apply for gst- cnt hold two office of profits

Apr 07Reply

luxuryrehomed

@sakhi_n the boutique certification is only for nwt from manufacturer goods right? I tried to register for GSTIN as a normal taxpayer....it's a very complicated process and requires lot of legal documentation it looks like. I think even PM hands must be tied as it's a govt regulation. Looks like a dead end for us till PM finds a solution :(

Apr 07Reply

mala_spice

I was using poshmark just to clear out my own clothes which I had purchased for myself but cannot wear anymore due to fit and change in personal taste. Definitely not as a business.

Apr 07Reply

amreenbeauty

Dear @pm_editor_in Please we request you to resolve this issue with GSTIN. We're a family here and we Posh Ambassadors have worked hard to keep poshmark the happy place to purchase for all the poshers/buyers. Kindly keep us updated with the communications with the government authorities so we know if there's gonna be any resolution. If not I hate to say this but most of us sellers won't be operating on this platform anymore :(

Apr 07Reply

sakhi_n

@dranukapoor I am telling you from my experience.. Taxation after GST registration is more tedious process ..so it's advisable for business who have turnover more than 20L to enroll fro GST..

Apr 07Reply

appu_s8

@a__star I agree. It’s time to say bye 🙁

Apr 07Reply

amreenbeauty

@sehgal29 I'm so not happy with the decision of the government authorities why don't they understand we're not huge businesses operating in different states in India on this platform earning 20 to 40 lakhs.. I just hope they'll be an immediate resolution for this chaos :(

Apr 07Reply

sehgal29

@amreenbeauty i feel Poshmark is not able to present their case well before concern or they themselves want to make another m**sho and just concern about their profit at large and treated us like dirt

Apr 07Reply

alao137

@pm_editor_in there is no way, we are all going to get the gst. This can trigger a huge immigration to other reseller app from Poshmark. Kindly, look into this issue seriously.

Apr 07Reply

sehgal29

@pm_editor_in we are all ready to file joint pil in case u r concern about our interest who has actually put an efforts to create listing n one day everything just washed away

Apr 07Reply

amreenbeauty

@sehgal29 I never thought about it that way, but it's so not happening cause there won't be many sellers operating on poshmark anymore except for few boutiques. Lol m**sho app is just a hype app one of the worst ones out there. But if poshmark wants to be one of them I'm wishing them good luck.

Apr 07Reply

luxuryrehomed

@sakhi_n yeah I can understand. I read that one has to file monthly or quarterly? Here filing the annual IT on regular income is such a hassle, who will file GST returns for that peanut earnings from PM sales 😱😭

Apr 07Reply

sakhi_n

@dranukapoor Exactly..i hardly earn 4-5 k monthly here..why should I go for such hassle

Apr 07Reply

luxuryrehomed

@sehgal29 if selling preloved branded good is not legal, how are businesses like Luxepolis thriving?

Apr 07Reply

sakhi_n

@azualacloset yes it doesn't make sense to register for GST unless you are a big business

Apr 07Reply

sakhi_n

@azualacloset Let's wait and watch..we are all in this together

Apr 07Reply

luxuryrehomed

@sakhi_n may be PM should go in for a consignment model, ie they sell goods on our behalf even though we do the listings, negotiations and the regular activities. I wonder if that is possible and would help. In that case PM would be the "seller"

Apr 07Reply

sehgal29

@dranukapoor if we talk the way Poshmark is talking than nothing is legal. I will say they have to work on their legal team . And yes i have read serval times on bill in t&c this is meant for personal consumption and not for resell. Luxpolis zinosa all r working well with support of good advisory and legal team

Apr 07Reply

aurora_wardrobe

@miraithrifts I see. I think the best way forward would be to clearly designate what qualifies as “business expansion”. Let’s consider this, anyone who makes 10-15< sales a month should be considered a “de-clutterer” and exempt from this change. I know this is more in keeping with an interstate sale- transactions rule but there must be a way to circumvent this? @pm_editor_in

Apr 07Reply

aurora_wardrobe

Can there be some sort of cap for number of listings, sales, transaction value per month to help allow us to continue here without a GSTIN? And those who wish to ‘further’ their sales beyond the allowed limit must then register/comply with this rule. @pm_editor_in

Apr 07Reply

a__star

@dranukapoor Consignment model will also require GSTIN.

Apr 07Reply

a__star

@dranukapoor Also let’s not forget the cost of filing. GST consultant charges, paying taxes and ensuring no mistake is made. Also the cost of applying for GST no. And the process is very tedious.

Apr 07Reply

closetbybr

@tanz_tanz

Apr 07Reply

sakhi_n

@dranukapoor makes sense

Apr 07Reply

miraithrifts

@thriftswithlove I’ve put a disclaimer! Sell as much as I can in two weeks as there is no clear solution to this right now

Apr 07Reply

miraithrifts

@aurora_wardrobe that is upto the govt

Poshmark can’t do it on it’s own will

Only if authorities agree will this apply

Apr 07Reply

miraithrifts

@aurora_wardrobe as per gst law, no matter the number of sales or earnings, if you want to make even one interstate sale through e-commerce, you need gst

Poshmark will have to talk to the authorities and come up with something for us

Because I am for sure not getting gst right now

Apr 07Reply

thriftswithlove

@miraithrifts same here

Apr 07Reply

tanz_tanz

@closetbybr Looter Govt needs more money

taxes from citizens are not enough.

can't even let people declutter and njoy shopping here on poshmark 😑😑

Apr 07Reply

aurora_wardrobe

@miraithrifts All discussions here are to try to get Poshmark to work around that rule (if possible) and if* there is any scope to remap their strategy while still in alignment with the law it is to create a clear cut distinction between income generating sales and personal de-stashing (just an idea). While this may disqualify some closets it will still allow people to engage on this app in an organic way. @pm_editor_in

Apr 07Reply

wearnew_2022

its time for shop . i have added 20+ bundle for purchase.

Apr 07Reply

aurora_wardrobe

@miraithrifts I won’t get one either. I don’t think most of us will. Is this really goodbye?😢

Apr 07Reply

tanz_tanz

🆘️📢 Hello Poshmark

Many sellers here are AAM AADMI (Normal People) decluttering their closet here!!

TAX THAT TOO? THIS IS OUTRAGEOUS!

‼🆘️PLS TAKE ACTION. ELSE

YOU WILL LOSE WONDERFUL BUYERS LIKE ME AND ALSO A HUGE SELLER BASE.

‼ I am a Regular Buyer on Poshmark.

‼ I DONOT WANT TO LOSE MY FAVORITE SELLERS !!

@shopfromk @anewstar @anishj @pm_editor_in

@anithasriraman

Apr 07Reply

miraithrifts

@aurora_wardrobe yes I totally get that and even I want some workaround

This was my only source of income right now, not a lot but I was able to float by atleast

Apr 07Reply

miraithrifts

@aurora_wardrobe i hope not

Because poshmark has more to lose than us! So many sellers will go away and pm will have to bear a lot of loss now

Apr 07Reply

miraithrifts

@aurora_wardrobe i hope it’s only a temporary goodbye! Because I want to declutter a whole rack of mine :’(

Apr 07Reply

aurora_wardrobe

@tanz_tanz This is what breaks my heart too. I’ve really grown fond of buying stuff on Poshmark and a lot of those closets were just people trying to de clutter and I happened to be interested in just the product they wanted to re-home. It will be a shame to see this all go.

Apr 07Reply

aurora_wardrobe

@miraithrifts I can understand how that must feel 💔 I really hope there’s something that can be done here.

Apr 07Reply

aurora_wardrobe

@miraithrifts We can only hope for the best and prepare for what seems imminent now :,(

Apr 07Reply

thriftstoreeeee

Yes team this is soo wromg on sellers side

Apr 07Reply

thriftstoreeeee

@amreenbeauty exactly

Apr 07Reply

thriftstoreeeee

@closetbybr exactly it’s useless

Apr 07Reply

thriftstoreeeee

@pm_editor_in please revert and helppp

Apr 07Reply

renuka29

I don't know where to begin with.

Already we get low offer on top of that poshmark cut and double tax on our sale for which we have already paid tax to govt while buying.Strange.

Apr 07Reply

poshandpanache1

@pm_editor_in

Apr 07Reply

poshandpanache1

@elizgeorge what is that?

Apr 07Reply

poshandpanache1

@elizgeorge oh, thats great. I have to check that. Thanks for the information.

Apr 07Reply

poshandpanache1

@elizgeorge okay, need to check that.

Apr 07Reply

a__star

@elizgeorge lovely suggestion ❤️❤️ Will find out about it from my consultant tomorrow

Apr 07Reply

a__star

@elizgeorge I think if POSH doesn’t want to lose sellers they will have to find a way. Not getting into GST to sell things lying at home.

Apr 07Reply

a__star

@elizgeorge exactly!! How to make sense of that here. When you get lowballed every single order.

Apr 07Reply

a__star

@elizgeorge They will follow suit soon.

Apr 07Reply

tanz_tanz

@aurora_wardrobe true

Posh is my go to place and I always enjoy. it relaxes my mind.

can't imagine now how it will be!

Apr 07Reply

tanz_tanz

‼‼ All sellers sending offers and clearance sale

I Think Posh Servers will crash now🤣🤣

this is so overwhelming!

Hope everyone make sales.

can't imagine poah without my favorite sellers 🥺

Apr 07Reply

sanateddy

@sakhi_n agree

Apr 07Reply

sparkle_3184

omg finally saw this.just now i filled my kyc&wth is this?i don't agree to this.am confused frm where to find gstin no. since mornin.what's wrong with pm!already this app is not populr among pple as far as i knw they evn collect 25%tax and now what's this?PPLE WILL STOP SELLING&BUYING FROM THIS PLATFRM IF TAXESetc IS TOO HIGH!every1 will switch to other platfrm if this continues..am a new seller here strugglin to fill all the details&very few ppl r intrsted in buyin even after workin so hard!

Apr 07Reply

luxuryrehomed

@sehgal29 oh I wasn't aware of that. In my opinion, these brands should be focusing on sale of counterfeits which is hurting their value more, rather than objecting to resale of preloved ones 😄

I hope PM finds a solution soon. I guess there is something like MSME registeration or udyaan or something which recognizes small businesses and requires only aadhar card for validation. Maybe that should be considered?

Apr 08Reply

sehgal29

@dranukapoor i wish it was MSME we all know itwas an not old denomination unfortunately not. It prima facie has its headquarters in US california. I think they have to pay major taxes to govenment so they planned to convert it into another APP having small business and home grown brand. Probably not for ppl like us. If it was made in india than it could have evade or you can say it literally fall in lower tax regime.

Apr 08Reply

sehgal29

@dranukapoor I think they r hiding lot from reseller like us. And other hand luxepolis at one’s deal in 0000’ n more unlike poshmark u knw

Apr 08Reply

shezzde1

@bec_care yes, we are selling for 200/-500/- items & imagine counting GST both ways is utterly rubbish..

Apr 08Reply

luxuryrehomed

@sehgal29 I remember when we sold our old car no one asked for gstin 🙈 here for selling personal old clothes gstin is required 😎😄😄

So you mean it wouldn't hurt PM to get rid of small fish🐠🐋🐟 like us?

Apr 08Reply

a__star

@dranukapoor shouldn’t we all write a letter to the PM?

Apr 08Reply

luxuryrehomed

@a__star I think we could escalate on Twitter tagging some influencers. I guess many women are benefitting from the platform and this is also an environment friendly activity. if we could tag pmo and other relevant ministry social media handles, maybe someone would pay heed?

Apr 08Reply

a__star

@dranukapoor I think we should do that. Because I just spoke to my tax consultant also and she also told me this makes no sense. Just because it’s an online transaction if cannot come under the purview of GST. The Govt. must distinguish between a second hand product and first hand. We won’t even get any GST input credit.

Apr 08Reply

luxuryrehomed

@a__star yes but someone will need to phrase up a properly worded thread with the proper terminologies. ideally it should come from Poshmark because we don't know exactly what was the cause that's led to this requirement and if they have taken any corrective steps/representation with the government authorities.

Apr 08Reply

a__star

@dranukapoor as per Government norms all online selling platforms have to pay GST, especially if the transaction is happening on their portal. But since this was 2nd hand it should have Beene edited but as Posh reverted currently there is no provision in the GST regulation to differentiate between first hand and second hand.

Apr 08Reply

a__star

@dranukapoor I am actually amazed at the Government. Posh is empowering homemakers and others to earn money through this app. Little money but whatever. Moreover, it’s protecting the environment because we are recycling in a way. So I don’t know why they would be so ridiculous 🤷♀️

Apr 08Reply

luxuryrehomed

@a__star I have read in gst regulations that individuals selling goods through ecommerce portals need to have gst, at the same time selling personally used goods are exempt from tax. Despite that we do pay tax through the deductions that Poshmark does from our sales. it's a very contradictory situation.

Apr 08Reply

a__star

@dranukapoor This yes could be because some sellers are using this as a platform to sell their business stuff. But for that I too have a Business account separate where GST is updated. So I don’t know why it should apply to all sellers.

Apr 08Reply

luxuryrehomed

@a__star Babus are "lakir ke fakir" 🙈😆

Apr 08Reply

a__star

@dranukapoor 😹🙈🤦🏻♀️

Apr 08Reply

luxuryrehomed

@a__star yes but then it will be difficult for poshmark to draw a line, how would they know who's doing it with what intent. Maybe they could set some limitations on the earnings? I wonder if anyone would be even in the taxable slab if we were to just consider the earnings from here.. especially with those appalling low ball offers 🙈🙈😆😆

Apr 08Reply

a__star

@dranukapoor 😹😹 Exactly the point. People want branded new things at the price of a second hand damaged product. What to say. 🙈 May be this is not the platform for luxury goods.

Apr 08Reply

jassi953

@tanz_tanz right 😂

Apr 08Reply

luxuryrehomed

@a__star no it is not 🙈 it is more of "kapda-mandi" 😄😄😆🙈

Apr 08Reply

a__star

@dranukapoor I think sabzi-Mandi

Apr 08Reply

sehgal29

@dranukapoor we are not even sellers our intent is not to earn profit. I purely believe Poshmark intention is just to throw everyone out n make it complete b2b and b2c business so they can earn in cr’s. They sniff audience here they know well how people dnt want to sell luxury here unlike other country. So less commission. We indian save every penny n smart enough. So i feel their profit is not much or i will say in their finacial statement liabilities r more

Apr 08Reply

sparkle_3184

aisa lag raha h sari duniya khatam hojari 20th april ku😪🤣

Apr 08Reply

alao137

Anyone tried to get gst no??

Apr 09Reply

bec_care

@henshuaeihly

Apr 09Reply

janujanu999

@alao137 yes I tried… heavy process

Apr 10Reply

alao137

@janujanu999 ok. I assume after gst no, there are lots of follow up process too

Apr 11Reply

thriftbazaar

@janujanu999 I hit this response fir my GST query. “GSTIN is mandatory per Govt. All e-commerce platforms will be impacted.The GST paid on posh earrings is also mandatory as it is a service rendered by PM. The pricing of products will have to go up accordingly, GST is mandated by Govt with penalties for non adherence” so looks like seller who earns any income from Posh will need to pay GST.

Apr 13Reply

alao137

@thriftbazaar ok. Thanks for the information and update. Is there going to be lot of follow up work after getting gst

Have you applied for gst no?

Apr 13Reply

sparkle_3184

@alao137 extended till april 30th!🎊🎊🎊

Apr 17Reply

janujanu999

@sparkle_3184 where???

Apr 17Reply

sparkle_3184

i got whtsp msg u didn't got?

Apr 17Reply

janujanu999

@sparkle_3184 yeah just now

Apr 17Reply

sparkle_3184

hey do check out my closet for amazing makeup skin care and jewellery products and follow for moregreat discount on bundles for offers check meet the posher page and for freebies check low to high price in my closet

Apr 17Reply

alao137

@sparkle_3184 yes

Have you applied for gst??

Apr 17Reply

sparkle_3184

nope I didn't

Apr 17Reply

aladoreferns

@sparkle_3184 How are you coping up with this GST thing U found another reliable platform ?

May 05Reply

sparkle_3184

@aladoreferns no..not yet..actually am quite busy so not working on it..but i have my store in oyela app..u can check am slowly adding up my things there.

May 06Reply

aladoreferns

@sparkle_3184 Oh cool

May 06Reply

aladoreferns

@alao137 Hi how are you coping up with the gst thing UK any reliable platform

May 06Reply

alao137

@aladoreferns hello. I am trying ins.ta and free.up

But it is not as good as Poshmark.

I am thinking to get a gst.

May 06Reply

aladoreferns

@alao137 Oh cool Thanks

May 06Reply

aladoreferns

@udhwanikajol Hi are u planning to apply for a gst no or what other alternatives you have?

May 08Reply

udhwanikajol

@aladoreferns yes I have applied by myself. Rest no app is as crazy as this one.

May 08Reply

aladoreferns

@udhwanikajol Oh cool

May 08Reply

udhwanikajol

@aladoreferns yourself?

May 08Reply

aladoreferns

@udhwanikajol I don't have a lot of items and actually haven't made any good sales here as well

May 08Reply

udhwanikajol

@aladoreferns TBH Will happen with time I joined in 2022 got my first order march 2023 and then it was a bomb journey.

May 08Reply

aladoreferns

@udhwanikajol oh wow 👌

May 08Reply

aladoreferns

@littleloots Hi how are you coping up with the gst thing. did u find another platform ?

May 14Reply

littleloots

@aladoreferns Hey. I don't have much more to sell as of now, but I've redirected people to my Inst agram page at little.loots.poshmark in case they want to buy something that's already listed here.

People who bought from me before the GST have become repeat customers and keep buying stuff so not really looking to put any extra effort into selling what's remaining.

May 14Reply

aladoreferns

@littleloots oh that's great 😁

May 14Reply

sparkle_3184

where r the ppl now who said pm is in los now..nobody will sell etc etc now everyone added their gstin lol

Jun 17Reply

Trending Now

Find Similar Listings